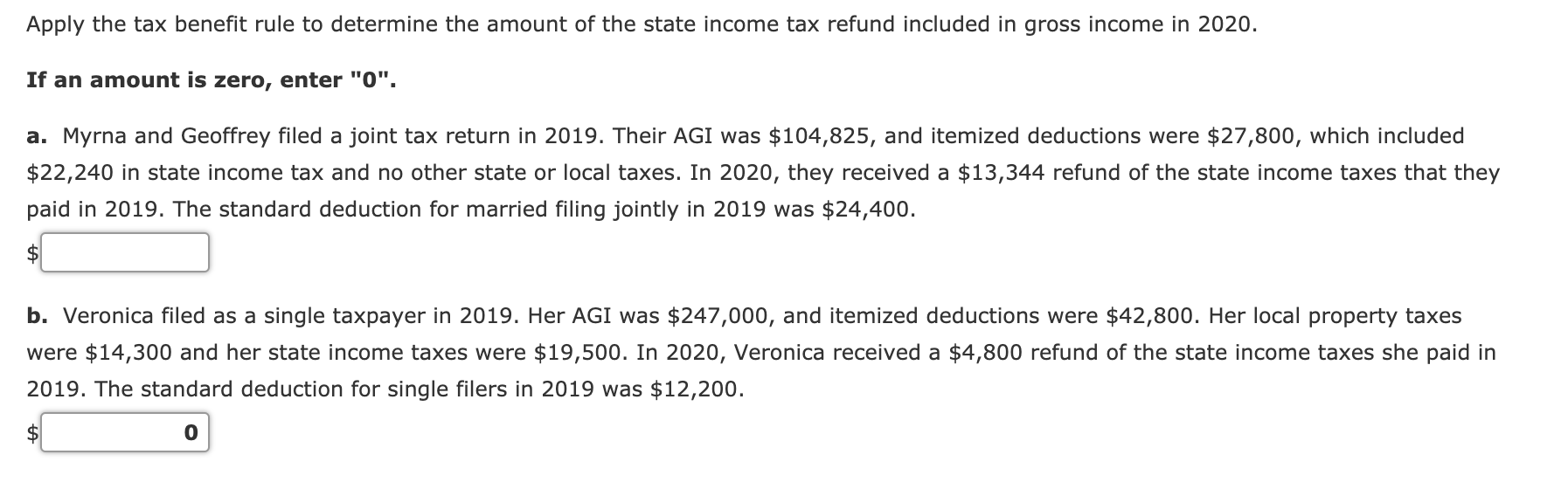

tax benefit rule examples

Example of the Tax Benefit Rule. However in 2012 the taxpayer receives a state tax refund.

Ppt Determining Gross Income Powerpoint Presentation Free Download Id 1641304

A few years ago the Treasury Department issued new regulations under section 501c3 with more hypotheticals illustrating key distinctions between the Private Benefit Rule.

. If an assignment or extinguishment of an intercompany obligation in an intercompany trans- action is otherwise excepted from the. Type of Fringe Benefit Income Tax Withholding Social Security and Medicare including Additional Medicare Tax when wages are paid in excess of. In one example described in the ruling a single taxpayer itemizes and claims deductions totaling 15000 on the taxpayers 2018 federal income tax return.

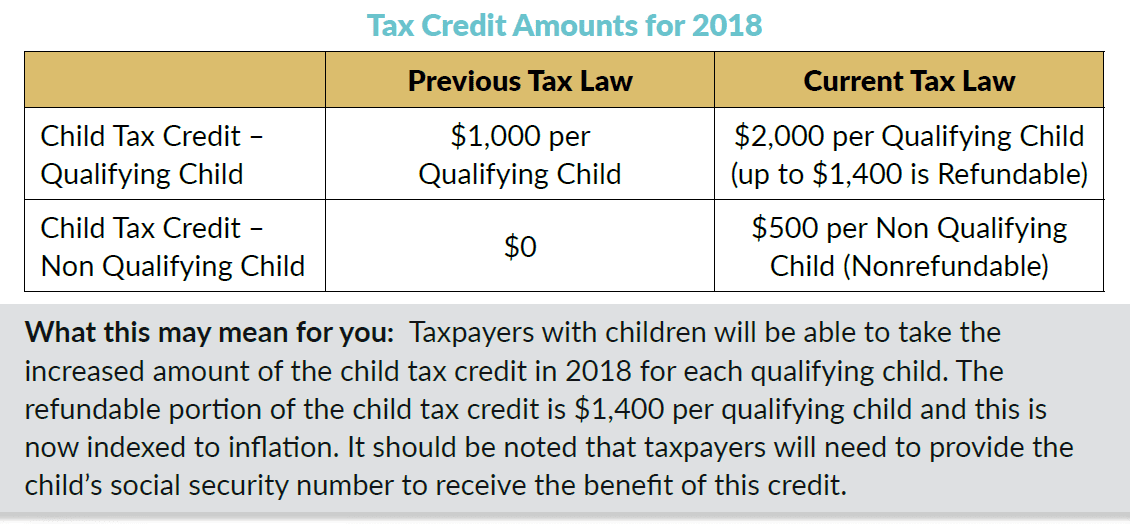

For example the Tax Cuts and Jobs Act TCJA of 2017 affected many tax benefitsadding some and taking others away. Examples of tax benefit. Example Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

Tax benefit rule examples - LetspracticeExample2TaxbenefitruleLouprepaysallofhishaircutsforthenext2. One tax benefit added by the TCJA addressed. Example A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000.

Tax on trivial benefits. What is the Tax Benefit Rule. It isnt cash or a cash voucher.

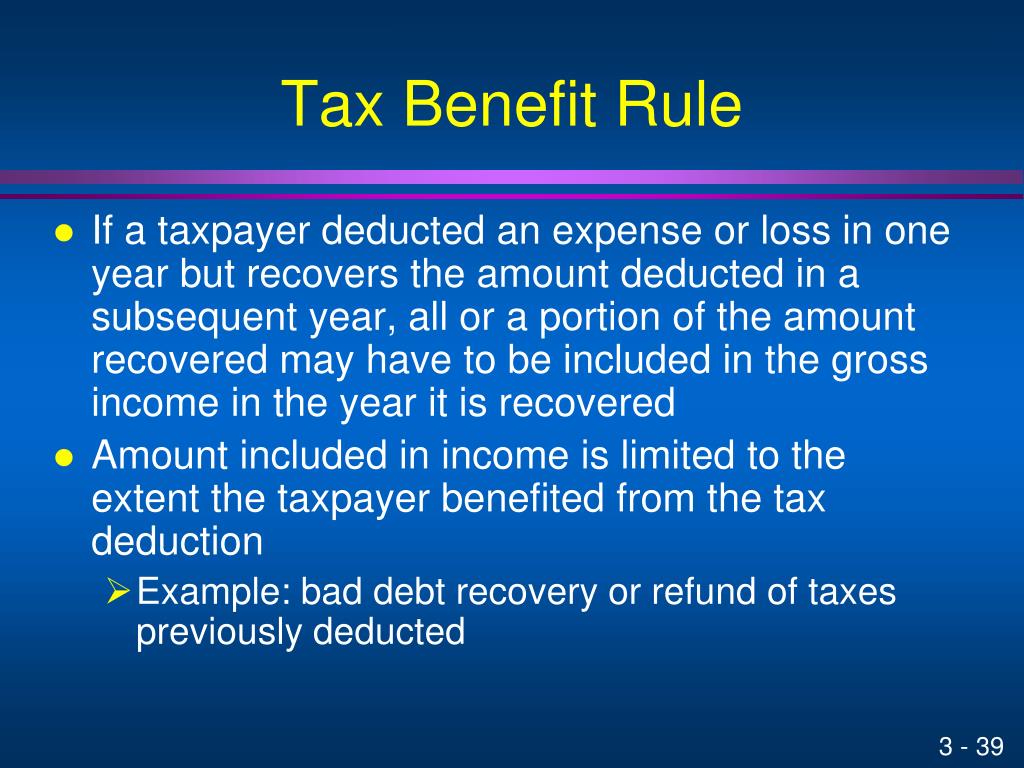

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. Legal Definition of tax benefit rule. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

It cost you 50 or less to provide. This represents the total amount of state income tax withheld from your wages in 2012 from. The customer never paid so.

You dont have to pay tax on a benefit for your employee if all of the following apply. According to the tax. For example - you deducted 1000 in state income taxes on your 2012 Schedule A.

A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. Treatment Under Employment Taxes. How Does a Tax Benefit Work.

If a taxpayer for example claimed as a business expense bad debts are written off amounting to 3000 in 2019 and in 2020 managed to recover 2000 of the amount written. Jones recovers a 1000 loss that he had written off in his previous years tax. The rule is promulgated by the Internal Revenue Service.

If the couple received a state tax refund of 500 in the current year the. Tax Benefit Rule Examples from PowerPoint Presentation 1. For example lets assume that in 2009 Company XYZ expected to receive 100000 from a customer.

A theory of income tax fairness that says people should pay taxes based on.

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Tab D Taxable Nontaxable Income Union College Vita Training

3 New Tax Rules Could Save You Thousands Dat Freight Analytics Blog

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

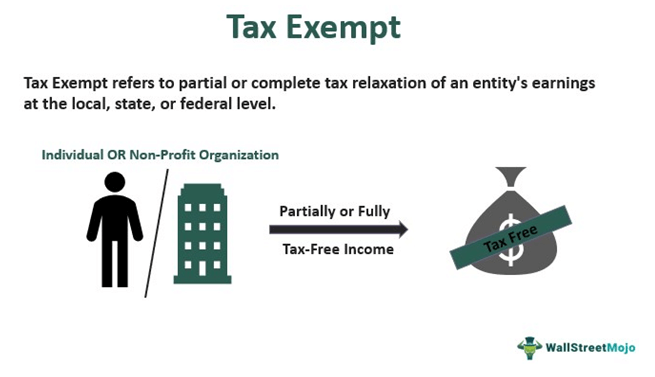

Tax Exempt Meaning Examples Organizations How It Works

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)

Tax Deductions And Credits Guide

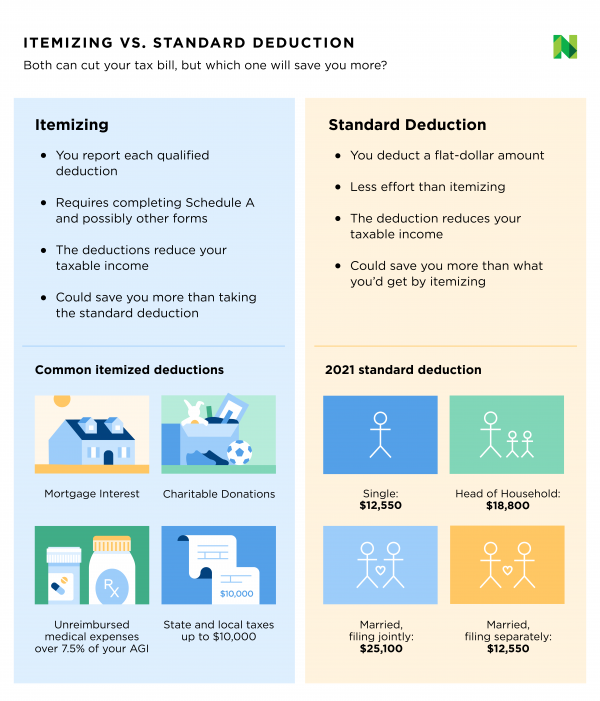

Itemized Deductions Definition Who Should Itemize Nerdwallet

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Learn More About A Tax Deduction Vs Tax Credit H R Block

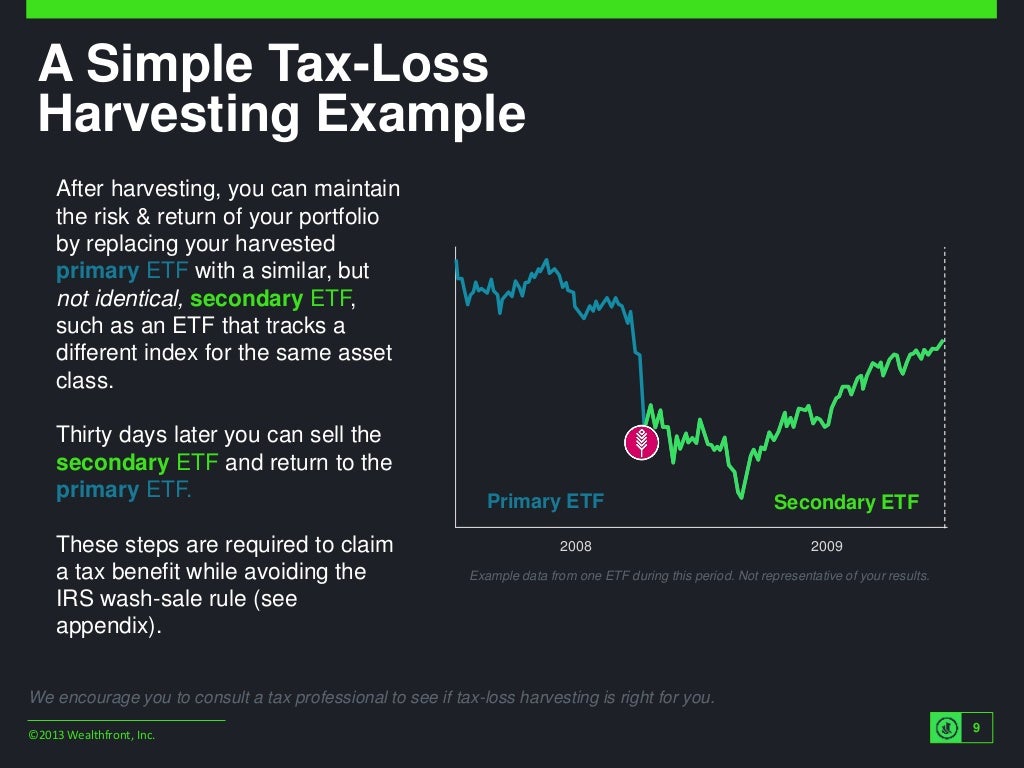

A Simple Tax Loss Harvesting Example

Attention Business Owners Section 179 Tax Benefits Caskinette Ford

What Is The Tax Benefit Rule The Benefit Rule Explained

Wash Sale Rule What It Is And How To Avoid The Motley Fool

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense